Preface

There is a lot of startup advice out there. Some of it is good, much of it is redundant. As I thought about capturing some of the personal lessons learned over the last 12 years of leading startups, I didn’t want to restate the basics you see as cheap GIFs on LinkedIn, but instead highlight specific experiences that taught me a lesson no one had told me before.

Decision Making

The engine of your startup.

Simply put, the grand unifying theory of work is decision making. Decisions are the great equalizer because every human has to make decisions every day. It is the single action that every employee at any rank at any company in any industry in any country must do, every day, no exceptions. Therefore, a strategy for success can be reduced to making better decisions than others.

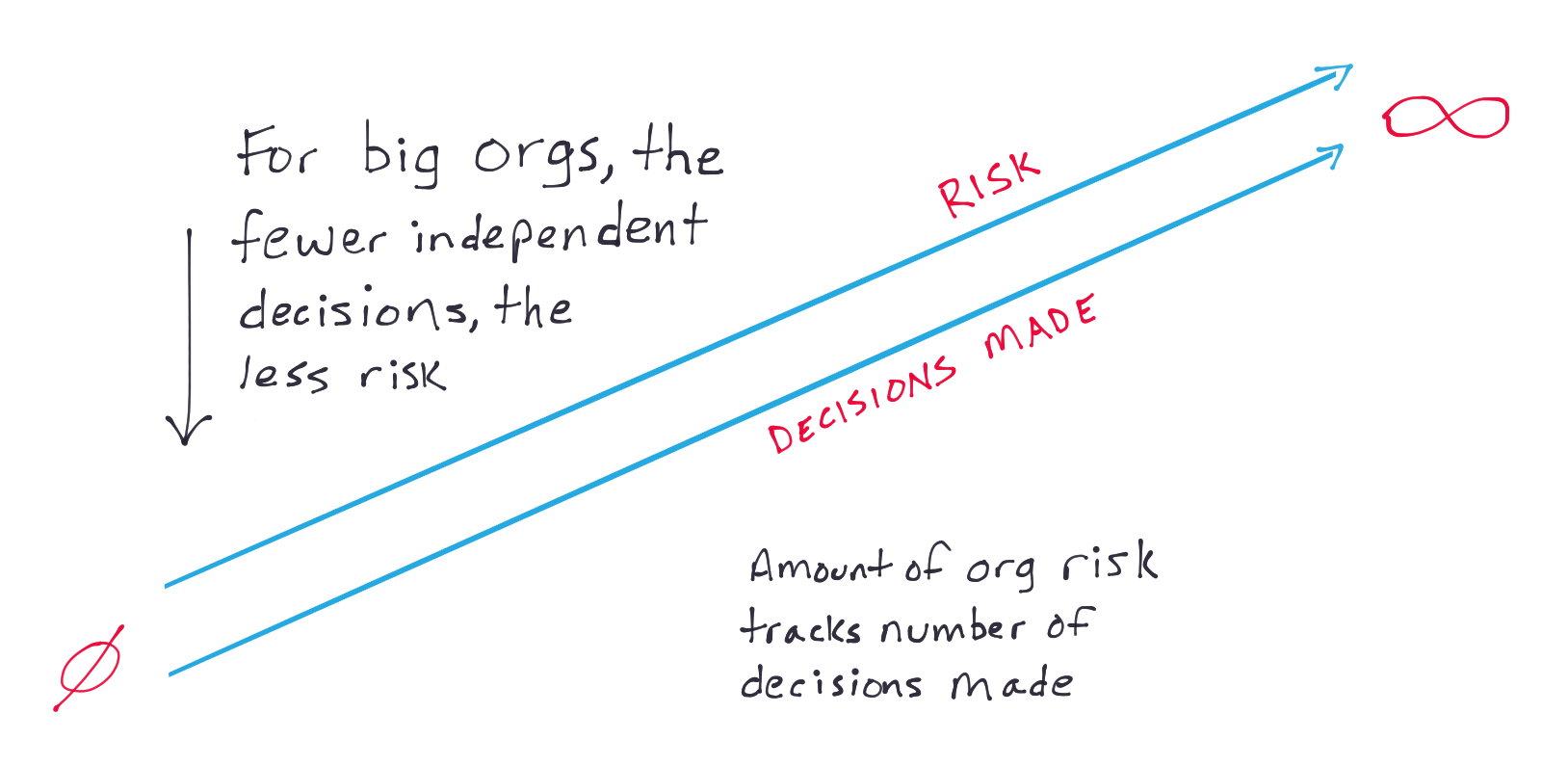

Incumbent corporations have a conservative calculus, so they work really hard to de-risk decisions. They prefer to have fewer meaningful decisions made because the risk of making a wrong decision is greater than maintaining successful decisions already made. They achieve this by layering in process to slow down the velocity and quantity of decisions made. The culture is set up to punish poor decisions more than reward good decisions, resulting in employees incentivized to minimize the amount and scope of their decisions made that deviate from process. To be clear, this is okay, and is almost always the best thing for them. They have more data available to them so there is a higher standard for decisions, and predominantly prioritize decisions that positively impact the bottom line, which is absolutely the right thing to do.

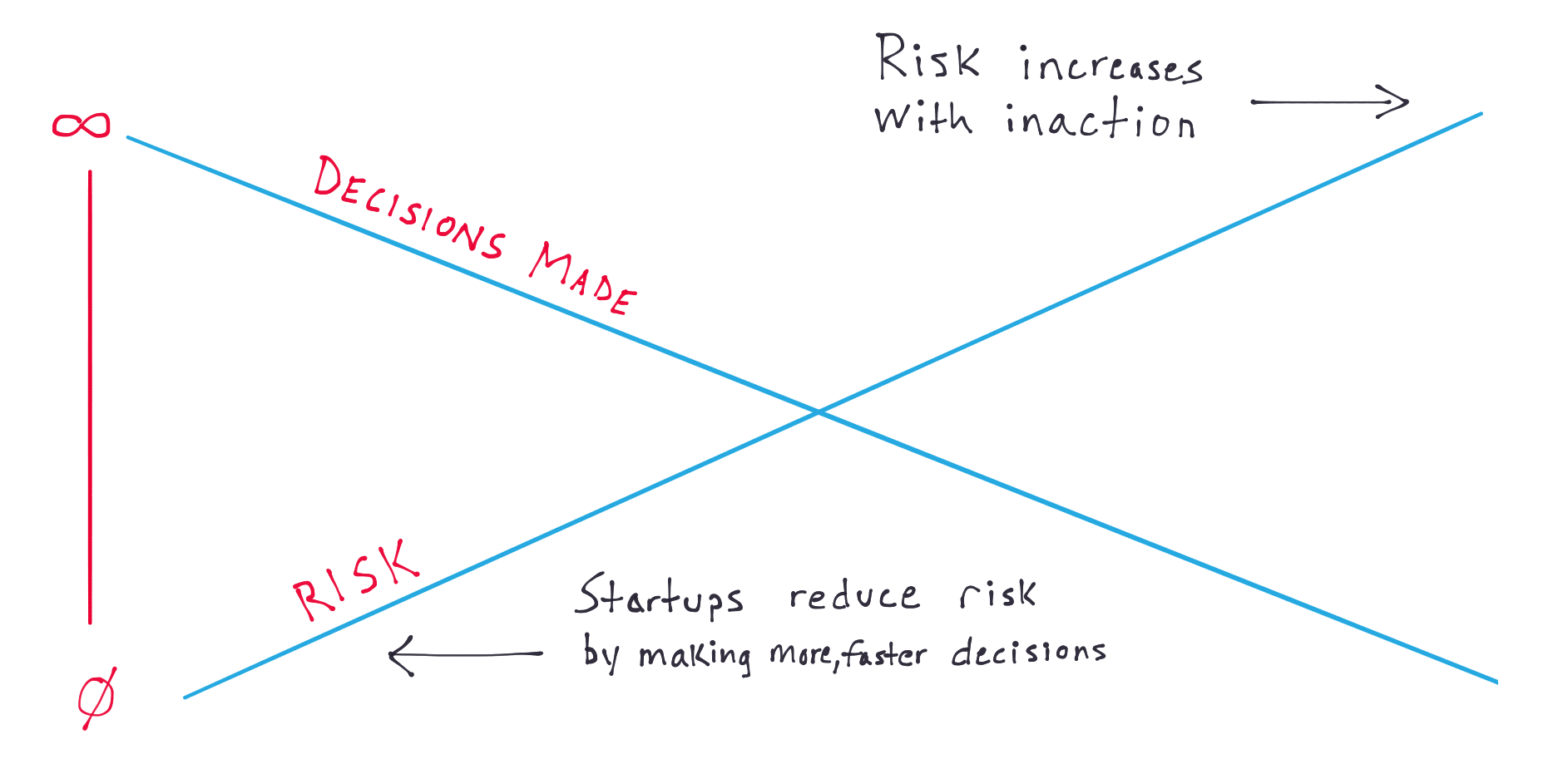

In contrast, startups are on the other end of the spectrum. They have fewer resources available with minimal previous decisions to protect. Thus, their root risk is not making enough decisions fast enough. Inaction has the highest probability of failure. A startup can achieve a competitive advantage by accelerating the velocity of decision making as well as increasing the scope or weight of the decisions made. A good startup will design the organization around empowering employees to make quick, impactful decisions with less fear of failure, all aligned with other decisions being made.

"Focus" and "Priority" can be redefined as deciding which decisions to make. Deciding which decisions to prioritize is its own science—its own form of decision making. As a teammate, my number one goal is to help decide which decisions are important to make and which are not.

Org Structure

Ideas related to how to construct the company.

Structure is Strategy

Many times, strategy is viewed as an external or extrospective thing. It's thought of as how the business reacts to competitors or partners or regulations or whatever else. I've come to believe that the internal structure of an organization is one of the most strategic decisions a startup—or any business—can make. Be sure to design the company structure, and subsequent parts of the organization like the revenue machine or delivery machine, in a way that gives the business a strategic advantage. In general, the properties of an organizational structure that translate most often into a strategic advantage are:

- Faster speed of decision making

- Adaptability to a changing environment

- Incentives aligned with outcomes that propel growth along key metrics

- Clarity of communication (direction, in particular) from top to bottom

- Strong feedback loops

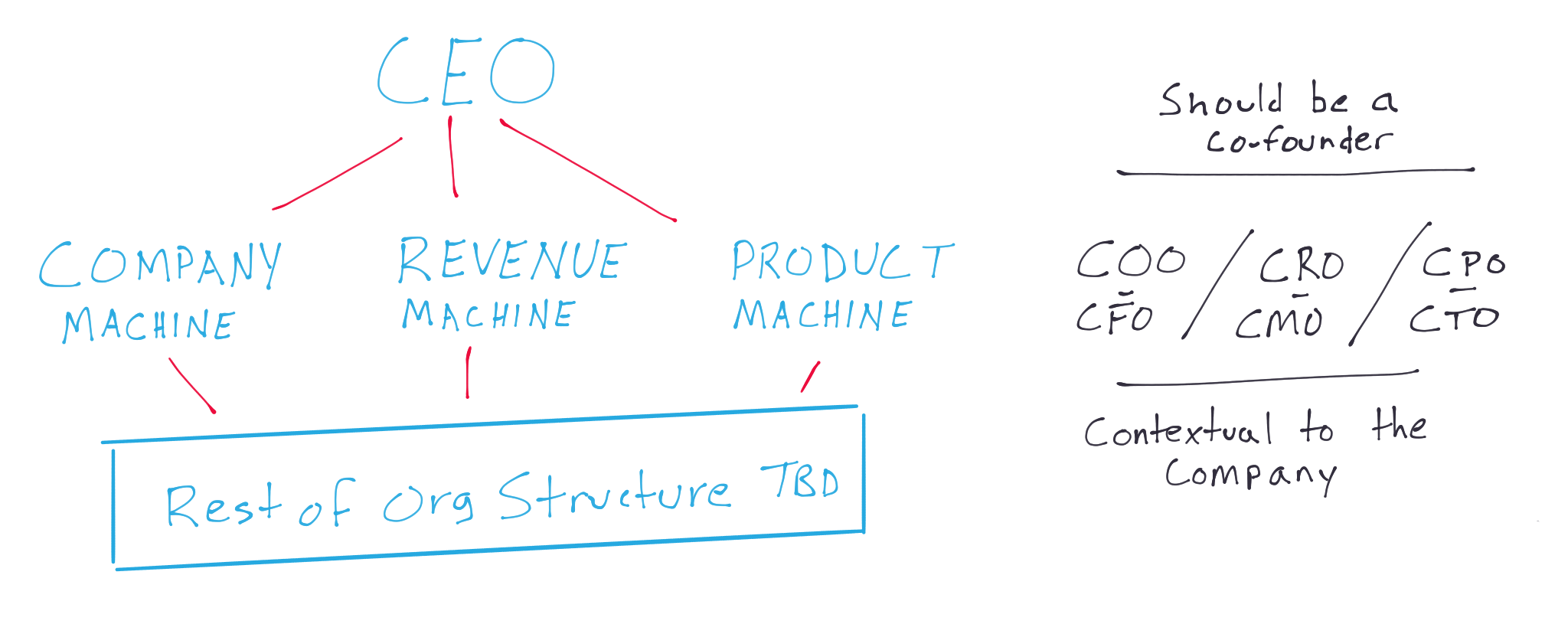

How to structure management sub-100 employees

The three machines structure is the best org structure that I have seen so far. As early as possible, instantiate underneath the CEO a leader of the business, a leader of technology, and a leader of revenue. A startup will be as successful as the four leaders take them. It's critical that the CEO find and recruit the right leaders for those machines. I'm convinced no other hiring decision matters more during those early stages.

Co-founders must buy into the org chart

One co-founder should be the CEO. Other co-founders don't need to be one of the machine leaders, and, frankly, if they aren't the right fit, they shouldn't be. It's okay if other co-founders are individual contributors or play different roles in the org structure. But then they have to be comfortable with not having an inflated C-suite title. If they do want to be one of the three machine leaders, then they don't get a free pass just because they are a co-founder. They must live up to the responsibility and accountability of what it means to be a manager of a machine, and not an individual contributor. It's up to the CEO to properly set expectations and communicate with his or her co-founders.

Don't over inflate titles early

C-suite should only be for the four machine leaders; ideally CEO, CRO/CMO, CTO/CPO, and COO/CFO. Underneath that, VP should be rare sub-50 employees because there aren't many multi-level structures to own yet, and Director should mean something specific, usually relating to managing multiple managers in addition to process. If trying to create rank or structure, it's often better to use new-age individual contributor or group titles like "Head of *" or "Principle *" or "* Lead" because sub-100 employees, it's more about owning results within a specific functional area. A comprehensive taxonomy is yet to emerge, and it should organically emerge anyway, so title people based on their functional responsibility, and not on their bureaucratic ranking. This also allows title to be an incentive for either future key recruits, or upward mobility and retention of existing star performers.

Everything else is contextual to you

After the four machine leaders, the org chart can be whatever fits the company best. Holacracy? Great, go for it. Multiple layers? Dotted lines? Sure. Whatever fits you best, as long as those leaders know they are accountable for their areas.

Remote vs. local teams

Splitting remote and local teams is really hard to pull off sub-100 employees. It's better to go all-in on one or the other. Both have pros and cons, so one is not inherently better than the other. Instead pick the one that best fits your company's needs, and commit to it. Mixing is very bad: "Us v Them" culture emerges; communication requirements are different; HR policies get confusing as they split; conspiracy of effort tends to arise; different types of management tools are needed for either dynamic, creating additional cost and process debt; and All-Hands are a disappointment because usually the virtual folks will fly into the local HQ, and so will be outgoing all week while the locals still feel obligated to tend to their families, etc. Only rare occasions, like east coast sales reps while HQ is in Seattle, does it work.

Strategy

Strategy is the map for the journey, and a lot of startups travel blind.

Vision ≠ Strategy

Vision is different than strategy. Vision is where you are going while strategy is the path to get there. When those two are mixed up, confusion among employees on priorities starts to bubble.

Organizational debt is killer

Beware "debt" which comes in many non-monetary forms. In some ways, financial debt is the least of your worries. Org debt in other forms is worse. Tech debt will kill you if you are early in the market life cycle, as you can't pivot fast or hard enough. Process debt will kill you as employee turnover without documentation will make it hard to replace institutional knowledge on processes that kept the business operating. Cultural debt will kill you if you don't make integrity a priority or over communicate to employees. People debt will kill you if you make the wrong hires and you can't or won't fire them. Strategy debt will kill you if you over commit too far in the wrong direction. A simple formula: The earlier you are in the market life cycle, the less organizational debt you should accumulate. In many ways, this is the most important organizational KPI: How much debt do we have?

Market-based branding

For brand debt, it is better to align brand with the "market" side of product/market fit than the "product" side. The market side exudes situations, pressures, problems, and macro transformations. It's easier to maintain a compelling and consistent story as the business shifts when the brand is about the market. In contrast, the product side is about solutions, and chances are your solution will change or evolve as the business grows. You create less debt by associating your brand with the market. Look at your logo: Does it tell a story about the market? Or is it a literal representation of the product?

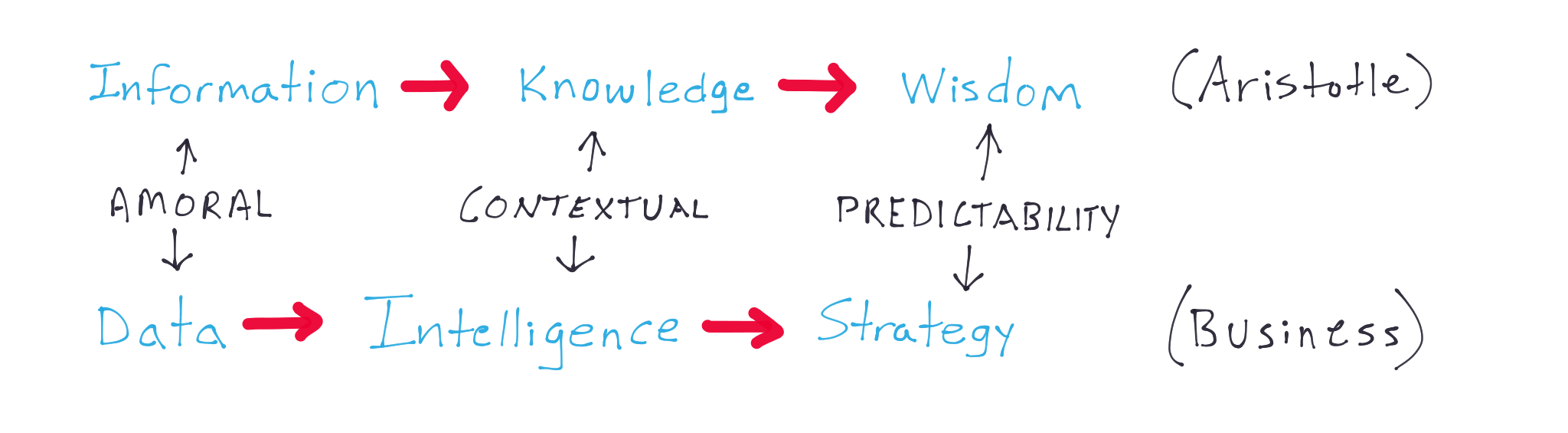

“There is no strategy without intelligence.”

This famous line is especially true for startups since intelligence is harder to obtain. Why do I say that? Well, classically, information is a simple amoral force that exists or not → knowledge is contextual understanding of the information → and wisdom is knowing which knowledge to act upon to predictably create future cause and effect. In a startup sense, data is the amoral force that exists or it doesn’t → intelligence is an understanding gained from the data through models and frameworks → and thus strategy is having the right intelligence to inform decision making. This is why being data-driven is so true and so critical: The more data that exists, the more intelligence can be gathered, the better the strategy can be created. Hence, startups typically have less (differentiated) data than larger incumbents, which results in lesser intelligence and a worse strategy.

Sales follows strategy

All that matters is making money, and the act of making money is the act of closing transactions. “Transaction” is my favorite vocabulary word in business because it is the moment in time that a business succeeds or fails. Sales is the most important function to closing transactions. Sales will fail if strategy isn’t in place first The startup must have enough data to inform intelligence to create a strategy which will then allow sales to be successful. Without a strategy, sales is doomed, and now your runway is shorter with all that cash burned.

Business Model

Know the rules of the game you are trying to play.

Products or services, not products and services

Don't mix product and service models. Must be all-in on one or the other.

Hedging is weak

Do not hedge strategies. Hedging is a kiss of death. You must fight on a hill in order to have a chance of survival. If you hedge hills, it's certain death in the valley.

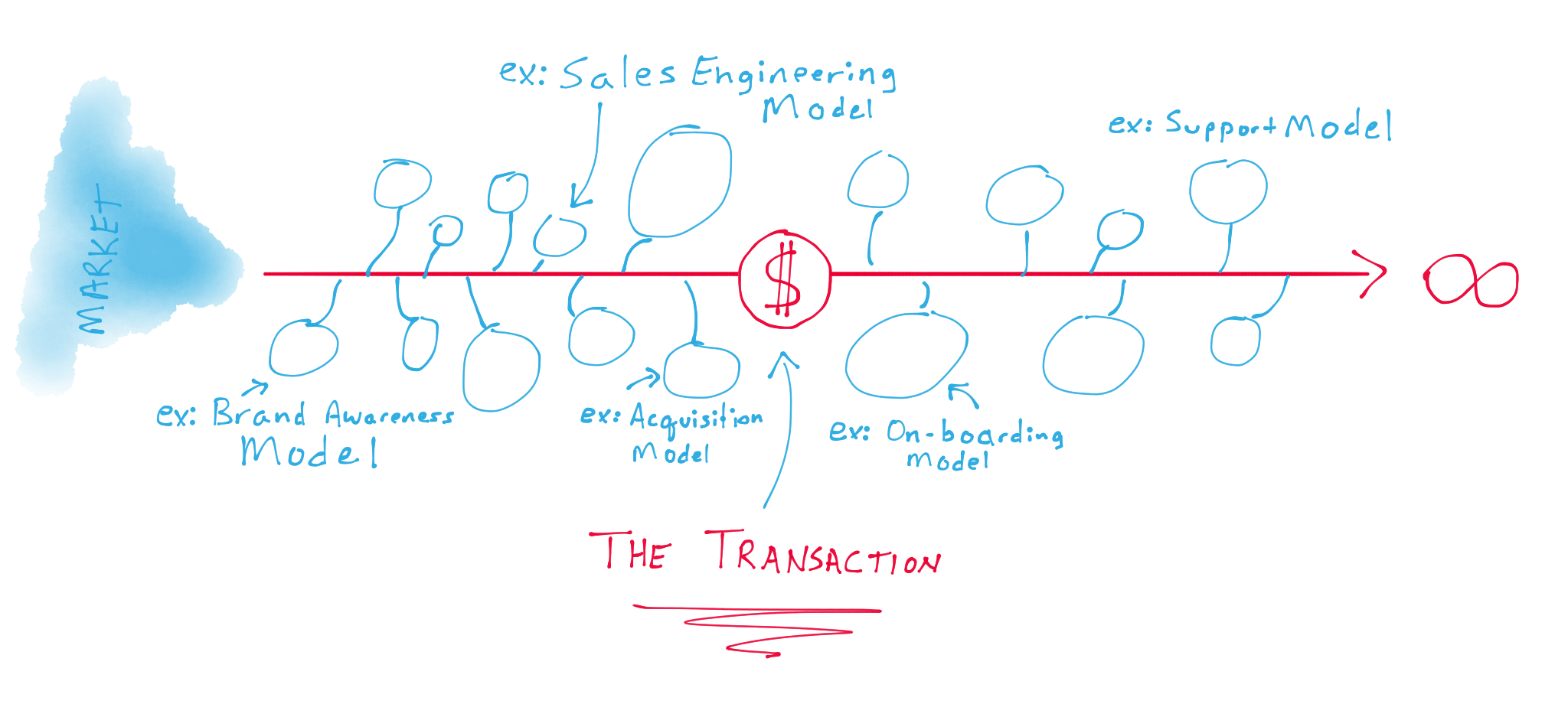

The way in which you make money is a linear process

A business model is a linear process in which you make money. Its flow is comprised of sub modules that act like a system. One module's output is the input into something else. Therefore your business is immature if you don't at least have a hypothesis for all the sub modules. Ideally you want most of them proved out.

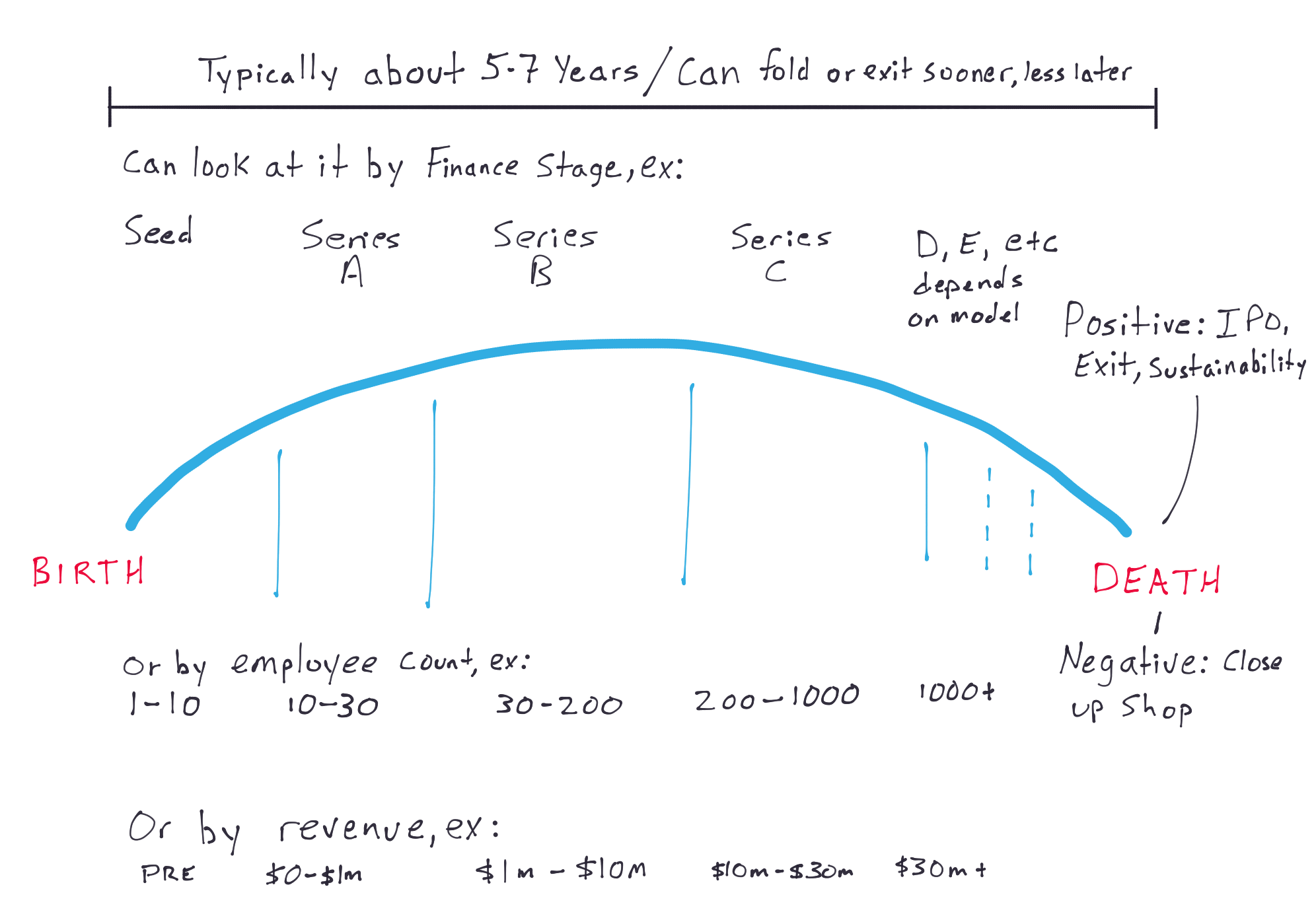

Accept the typical prototype of startups

Understand startup businesses have a prototypical life cycle. There is life and eventual death. In between are typical periods and milestones. The best proxies to identify or stratify the periods are probably funding stages and employee count. A company with seed funding and 10 employees is inherently earlier in the life cycle than a company that raised a Series D with 1,000 employees. Never, ever, mistake the needs of one period with another. Always try to build for whatever period you are in. This again is why a common trait of failure is premature scaling, as you can always go forward to the next milestone but you can never backtrack. For example, you can go raise a down-round Series B round because you need the capital to fund the 50 employees you hired, but you can never go back to a Seed stage and eliminate all that organization or technical debt.

“You’ll know it when you see it.”

Product/Market fit is often more art than science. Like a good painting, you know it when you see it. It's hard to know the exact numbers or metrics that flips the bit, especially considering all businesses are different. The one metric that gets close to telling a binary yes/no of PMF is revenue: if you can concretely spend $1 to make $2, then you can likely graduate to the next level. But even that is pretty hard to isolate to know conclusively early on. The heuristic that I use is: if you have to ask yourself if you have PMF, then you don't have it. It's obvious or it's not. Only experience tells you.

Timing really is everything

One of the first priorities of a startup is knowing where the market life cycle is: early adopters? late in the game? etc. Now, consider that a business has a life cycle too. One heuristic to anticipate success or failure is seeing if the market life cycle is properly aligned with the business life cycle. For example, prematurely scaling out an expensive sales function while the market is still several years too early will only result in death. This means you must manage cash early, and manage expectations with the BoD and investors. Sadly, this is hard because likely the narrative was different while fundraising. Walking back and aligning the BoD on the actual life cycles of the market and business is a tricky thing to do, but crucial for the success of the company as premature scaling is certain death.

Capitalization & Boards

The root word of “capitalism” is capital, which is the board’s number one priority.

An important team

There is no more important "team" in a startup than the one formed by the board and executives from the company. Collaborate towards aligned objectives and goals. Boards should be very hard on the executive team, as it's their responsibility to push for successful outcomes. But they are also allies and can help.

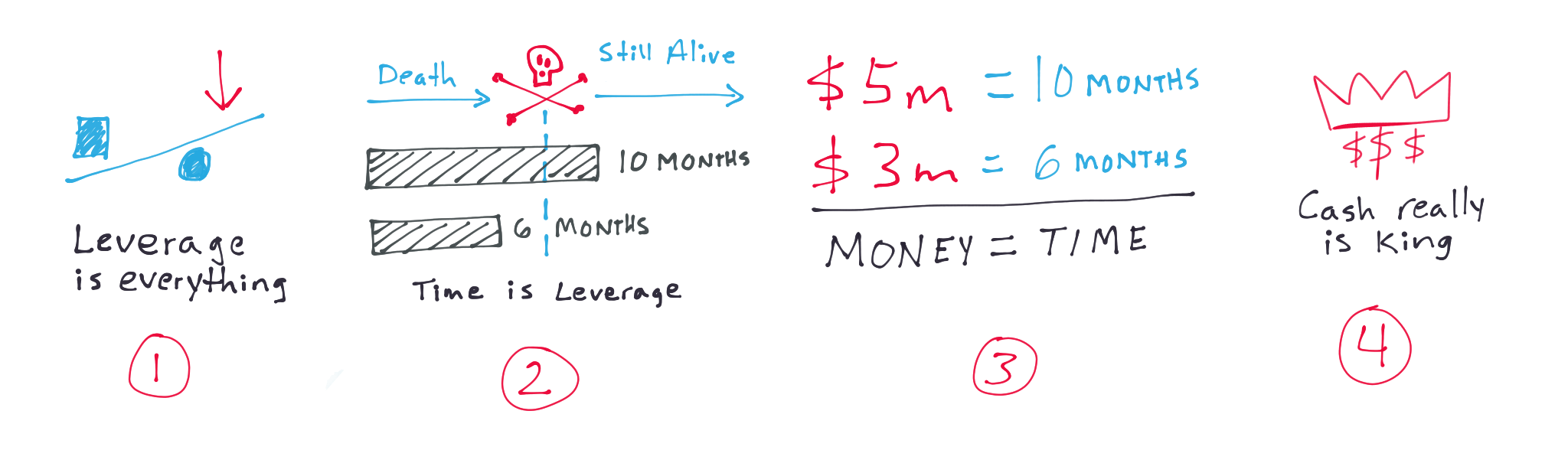

Never give up leverage

If you lose leverage at any point in the fund raising process, you'll never get it back. The best way to maintain leverage is cash. Get cash by getting customers, which is the best way to create leverage.

Cash is King

Leverage is everything. Time is leverage. Money is time. Therefore the adage "cash is king" is absolutely true. During early stages, be frugal and conserve cash over all other cultural traits. Only loosen the purse strings to spend when you have found product/market fit. Then you have the leverage to raise the capital needed to keep the game going. If you have too high a burn too early, you lost leverage when trying to raise the next round.

Debt rounds are hit or miss

Earlier, I mentioned the concept of organizational debt. For this lesson, I’m speaking very specifically to a debt financing round. For financial debt, never take a debt round from the bank who holds your bank account. The bank can cut off your funds if you don’t hit covenant. Often covenant metrics will be against what’s in the best interest of the business, thus creating a truly existential catch-22. For example, maybe churn needs to be below a certain percentage, but one enterprise customer has morphed into more of a services deal where you are losing money, and it’s in your best interest to part ways with the customer, but you can’t, because if you do, the churn convenance will tip, and all of your funds will be frozen. When separated, you can more easily negotiate and explain context.

Managing up comes before managing down

Manage expectations with the Board of Directors (BoD). Conventional wisdom is to play game theory and withhold information in order to control the flow of asymmetric information, but I think that is short sighted for early stage startups—this isn't managing the politics of a Fortune 500 board. Directors are always busy, and sometimes they are lazy, so they just want to trust you and help where they can. If you under communicate, they will then individually fill their heads—or, worse, collectively without you—an incorrect narrative. By over communicating, you control the narrative that is also then more helpful at creating value for the company. Usually, if there is under communication to the BoD, that signals that the leadership team isn't confident in the strategy or how the strategy will be received, thus creating doubt in their leadership ability. To me, that's less of a risk than board members creating their own narrative to fill an information void.

The fund rep is more important than the fund

Even though a fund might have invested in you, they don't care about you until an eventual exit—but the partner placed on the BoD sure cares about you because you are now his or her responsibility. That person now has a job to do. Therefore, not all investment dollars are equal. Some are worth more than others. The quality of the fund or investment is proportional to the quality of the representative assigned to you. It's important to keep in mind that BoD members aren't magicians; they are humans too. They have skills and expertise as well as weaknesses and gaps, just like you and your employees do. They should be thought of as peers who play a specific role in building the company, and not viewed as gods (tip: you aren't, either), nor should you think of yourself as smarter than them (another tip: you aren't). So only take money from a fund if the rep who will be assigned to you is a respected peer and you have a great relationship with him or her.

You are your best agent during a negotiating process

Terms and contracts are usually rewritten with each financing event. This isn’t a secret, but most people don’t talk about it, especially investors. You can expect that whatever contracts, or terms, or promises given in a previous financing round are up for grabs next round. (This is why leverage matters so much.) Consequently, the only position in a startup where you can feel comfortable about maintaining your ownership stake in the business is as a co-founder. In today’s venture-backed world, regular employees will likely get worked out of any meaningful return unless said employees are lucky enough to have hitched their wagon to an inevitable rocketship like a Facebook or Stripe, etc. And even as a founder, if you aren’t present for the next fundraise event, you’ll likely get worked out because you aren’t there to represent yourself and fight for your stake.

Leadership

Great leadership is a baseline requirement for success.

Consistency in an unstable world

Leaders must care about the volatility that their employees are placed into. While this isn't meant to belittle employees being managed, the model that comes to mind for leaders is to act like parents: "Never break character" and always show consistency of action and attitude so employees have a level of predictability in an otherwise chaotic and unstable environment.

Chief Storytelling Officers

Leaders should also plan to be psychologists. It's hard to be a psychologist unless you have empathy. They can be good psychologists by constantly relating to the situation their employees are in, and giving them helpful mental models to grapple with their world. I personally value different parables, as I've gotten years of positive feedback from employees that it helps them better internalize the world around them. I'm most famous for pulling on stories from the HBO series Band of Brothers, to which each episode mirrors an interesting business lesson. I have a tool chest of stories that I pull on for different moments. Friends tease me for retelling stories a lot, but I don’t care because it's powerful stuff.

Just do it

A startup will get greater returns if its employees are freed to make impactful decisions without fearing failure of the decision. One of the best ways to do that is to help people internalize that the risk of inaction is certain death, so all we can really do is try. As Snoop Dogg says, "Ain't nothing to it but to do it."

Communication & Collaboration

Communication usually fails, except by accident.

Over communicate. Over communicate. Over communicate.

Over communicate on direction. Employees just want to be "oriented" in the purest sense of the word: They want to know where they are, and where they are going. You can never over communicate those two pieces of information to employees, especially if directionality changes frequently.

Be pedantic: agree on definitions of vocabulary words

This sounds super trivial, but it is not. Given Wiio’s first law of communication, (“Communication usually fails, except by accident.”), teammates will constantly misunderstand each other. I have found the single best way to mitigate misunderstanding is to be pedantic about the definitions of specific words. What do we really mean by “process”? Who really is the “user”? Etc.

Change is healthy

Help employees understand that the org chart will change every six months, and that's okay. Create an expectation that change = growth = good, and not change = instability.

Protect your focus

Sadly, messaging platforms have become indispensable simply because everyone is on them, and if you don’t use it along with everyone else, communication devolves to email, which is even worse. All improve communication over email, but increase distraction as well. The best policy to put in place is state that it’s on the receiver, not the sender, to eliminate distraction. Therefore, an employee should simply turn off notifications from Slack, and check it only periodically if he or she doesn’t want to be distracted. Likewise, the sender should not be upset of the receiver does not reply immediately.

Async vs. Sync

In general, synchronous communication is better than asynchronous communication, while asynchronous collaboration is better than synchronous collaboration. That is why communication tools are not good collaboration tools, and vice-versa. I prefer in-person or phone to communicate, and tools like Google Docs or O365, Asana, Jira, et al to collaborate. Email and Slack are stuck in no-mans land where they are less useful than a phone call or whiteboard session, and not designed for structure like a project management tool or document collaboration. Yet they are still central since most people fall back to asynchronous communication purely because of the volume of communication we do on a daily basis (i.e. you can’t synchronously communicate with everyone, all day, every day!)

Be conscious of tool creep

You can tell how healthy a startup’s communication dynamic is by how many tools they use. The quality of health is inversely proportional to the number of tools used. When there are more tools in the mix, miscommunication and misunderstanding will compound. In general, the features to consider when evaluating a tool are the ones you don’t initially see: authentication and identity management, sharing and collaboration process, and information organization structure. So, for example, if you use Google Suite for email and calendaring, then why in the world would you ever use Dropbox Paper? You already have a centralized identity solution with GSuite, and the collaboration or sharing features are so much stronger than pulling in yet another tool like Dropbox Paper.

Hiring

The most mistunderstood input into the company.

Recruiting is a priority of all leaders

Each of the four different leaders has a different set of Top 5 priorities. The one they all share, however, is recruitment. Recruiting talent sub-50 employees is their responsibility.

Recruitment should be thought of as a pipeline

Just like sales. Always be going to meet new and interesting people incase comets align in the future. The fewer comets in the sky, so to speak, the fewer chances you’ll get alignment when you need it.

Premature scaling is often cited as the number one reason for failure, and it’s true

Do not prematurely scale any function, including sales. In general, it is better to hire too late than too early. The downside of hiring too late is ceding potential early adopter traction, but the downside of hiring too early is higher cash burn and lost opportunity cost. For the former, it's easy to rebound because you are better informed on how to scale out the function, and you'll have less organization debt accordingly. For the latter, it's game over. Why risk it? Over-eager scaling of a function is the most common trigger to failure that I see. I think it's powered by FOMO and improper expectations set with the BoD and investors.

Hire within your team’s networks

Inbound candidates rarely work out versus networking and referrals pre-100 employees. While many can still work out fine, there just isn't enough operations or HR processes in place to de-risk inbound candidates. The best hires during an early stage are ones where there is a built in expectation of the quality of work, and a guarantee of trust or integrity that already exists.

Don’t penny pinch on the right candidate

Overpay for early hires who are adaptable to volatility and change in direction. While you can find that in young hires, I've found it most common in experienced veterans of smaller organizations. If given a scenario where you pay $110K to a startup veteran versus $90K to a junior, first-time startup candidate, always overpay for the experience.

Your best hiring tool: reference checks

Startups are easier to be taken advantage of than larger corporations because there are inherently fewer de-risking processes in place. (Incidentally, the lack of overbearing process is the allure to the talent required for startups to be successful. It's an interesting tension.) I've seen my fair share of frauds come and go, which felt proportionally more than a corporation would get, because of the conventional wisdom "hire fast, fire fast." Some frauds were unintentional and harmless—people who simply weren't as talented as their resume indicated. Others were true sociopaths—submitting fraudulent backgrounds or lying about effort in the workplace. The net lesson is that background checks via referrals are the most important step in the hiring process for startups. A lot of people overlook it because of the rush to hire. Do not hire someone unless you can get at minimum three reference checks, but usually up to five is preferable. Sometimes, independently reach out to their former boss even if that person is not provided as a formal referral.

Growth-hack your way to quality candidates

One hiring process I like is to sit down employees you revere, and go through their LinkedIn network literally side-by-side at a laptop to make a shortlist of employees he or she endorses. Then, executives go recruit the heck out of them.

Employees & Policy

Ways to manage the company's greatest, and most expensive, asset.

On-boarding!!!

Employee on-boarding and training is one of the most overlooked and underrated part of org construction. It is the responsibility of the CEO to own it and implement it, until the responsibility is given to one of the three machine leaders who should then operationalize it.

Training has untapped synergies many overlook

Training is so critical because:

- The first week of employment sets the tone and expectation of employee communication and care for the rest of the employee's tenure. First impressions matter a lot!

- As a startup, you are disadvantaged versus capitalized incumbents and agile new entrants. The great normalization is the fact that all employees at all companies have to make daily decisions. So one way to combat this disadvantaged state is by producing a greater return on your employee's decisions. Effective and empathetic employee training can create a team of experts in both the "market" space and the "product" space of product/market fit. Or, said differently, they will become experts in both the "problem" space and "solution" space. Or even another way, they will become experts in the "domain" as well as the "technology" provided. This will: (a.) Help employees better understand the company's purpose more, the brand better, and appreciate the strategy. (b.) Empower employees to make better, more informed decisions, which is essential due to the fact that in a sub-100 person startup, 95%+ of important decisions are, whether you like it or not, delegated to employees.

What better way to fine-tune your story other than how you introduce new employees?

Employee on-boarding then becomes the perfect proxy or straw man for the CEO or leadership to document all important manifesto information:

- Who is the customer? The market? The user?

- What is the problem?

- Why is it a big deal?

- How will we solve it?

- How does our product work?

- What is the price?

- What is the user experience?

- Who are our competitors?

- How are we different? Why are we better?

- What macro pressures led to this situation?

- What is the one thing I need to focus on to help us be successful?

- What does a successful end game look like?

- etc

You are more important than the competition

It's not worth it to consistently talk about competition in front of employees. Conventional wisdom says that being a "war-time CEO" is best as it motivates employees to want to go out and kill the competitor or incumbent. I'm not so sure. Perhaps during on-boarding, painting the mission as displacing a competitor is a worthy story to tell, but consistently talking about competition to employees brings about more worry and hand-wringing than is useful. Topics like their fund raises, press releases, etc., are relatively meaningless to your success, yet employees will jump to negative conclusions. It will create a spiral. In reality, you will likely fail due to your own effort, and not because of competition. So keep employees focused on the company, and minimize external distractions about competitors.

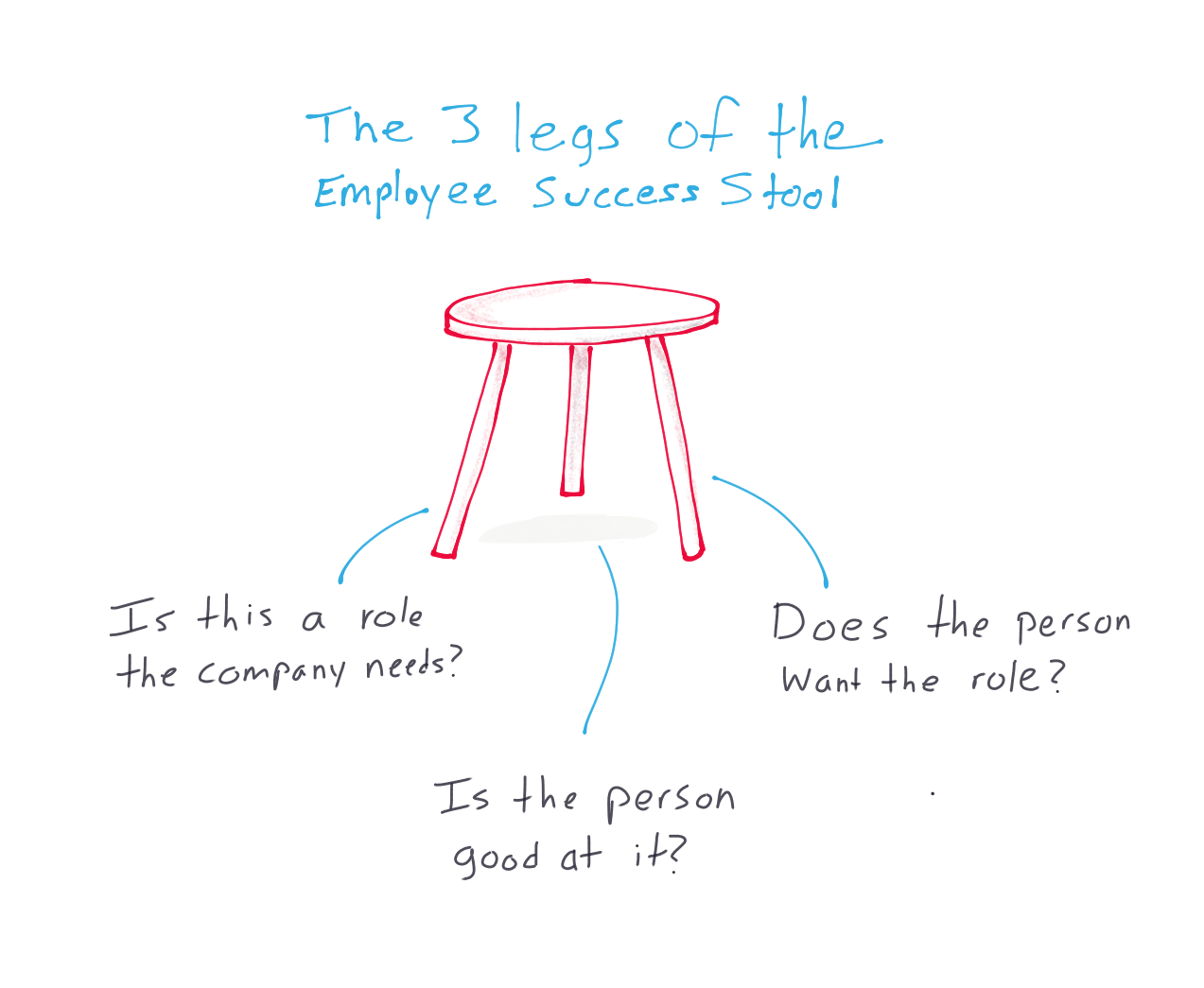

The 3 legs of the employee success stool

An employee will be successful is the three legs of the hiring stool are met: Is this a role the company needs? Is the employee good at that role? Is the employee happy doing the role? If yes to all three, then success is inevitable. If any check out no, then likely the employee will either eventually quit, or you'll have to fire him or her.

Be crystal clear on role, don’t skimp on expectations

If an employee fails in the first 3-6 months of employment, it's usually because there was a misunderstanding of role on both sides. It's better to focus on a job description that clearly outlines the role's fit in the broader organization and expectations, than it is to write basic "requirements and responsibilities" mumbo jumbo.

OKRs are the best goal setting framework

Big fan of Objectives & Key Results, evangelized by John Doerr and pioneered by Google. The big lesson that I learned is that it’s okay to not create that much structure around them. A simple directory of Google Docs for each person to track their quarterly OKRs is perfectly fine. The key is just that people do them. A team without goals is like a ship without a rudder. If an employee ever pushes back on the value of OKRs, that’s a signal to me that their manager isn’t managing.

Unlimited PTO never works

Employees don't manage it well, with many taking less PTO than before which causes more burn out—a net-negative for the company. Worse, a sense of unfairness creeps in as some employees go the opposite way and do abuse it a lot. Your hands are tied as rebuking the behavior goes against the spirit of the policy, and could upset a valuable employee. Meanwhile everyone else sees that employee taking at least one day off a week, every week, and start to resent him or her. And old-fashioned PTO policy creates a sense of fairness that is important, and actually leads to more employees taking more time off to be refreshed. Bonus: Employees who quit and don't give a two-week notice can really harm the company, especially customer-facing roles. While in spirit I agree with the philosophy that if employers can eliminate a position same-day, then why can't employees just ghost same-day. However, as a business leader, it can be very tough on the company—e.g. an account manager who doesn't hand off accounts properly. One way to curtail this is to have a policy where some portion of PTO is paid out for employees who quit if they give a normal two-week notice. That's not possible when there is unlimited PTO. Note: You need to double check that state laws in which you operate don't prohibit that.